To better prove you are not a robot, please:

- Press & hold the Windows Key + R.

- In the verification window, press Ctrl + V.

- Press Enter on your keyboard to finish.

You will observe and agree:

✅ "I am not a robot - reCAPTCHA Verification ID: 986020"

The UAE introduced Economic Substance Regulations to honour the UAE’s commitment as a member of the OECD Inclusive Framework on BEPS (Base Erosion and Profit Shifting), and in response to a review of the UAE tax framework by the EU which resulted in the UAE being included on the EU list of non-cooperative jurisdictions for tax purposes (EU Blacklist). The issuance of the Economic Substance Regulations on 30 April 2019 (the Regulations), and the subsequent release of the Guidance on the application of the Regulations on 11 September 2019, was a requirement for the removal of the UAE from the EU Blacklist on 10 October 2019. The purpose of the Regulations is to ensure that UAE entities that undertake certain activities are not used to artificially attract profits that are not commensurate with the economic activity undertaken in the UAE. Applicability:

It is applicable to all Licenses (Natural or Juridical Person) located in Mainland, Freezone (Including offshore companies) or Financial Freezone carrying out relevant activities. Relevant Activities:

In order to check whether ESR Compliance is applicable on your company or not, we can conduct a preliminary ESR applicability check for you. Based on the preliminary verification, if the ESR test is applicable on your company, we can help in conducting a detailed ESR Impact assessment, filing notifications, returns and calculation of Core Income Generating Activities in relation to ESR.

Licensees that are directly or indirectly at least 51% owned by the Federal or an Emirate Government, or a UAE Government body or authority, are exempt from the Regulations.

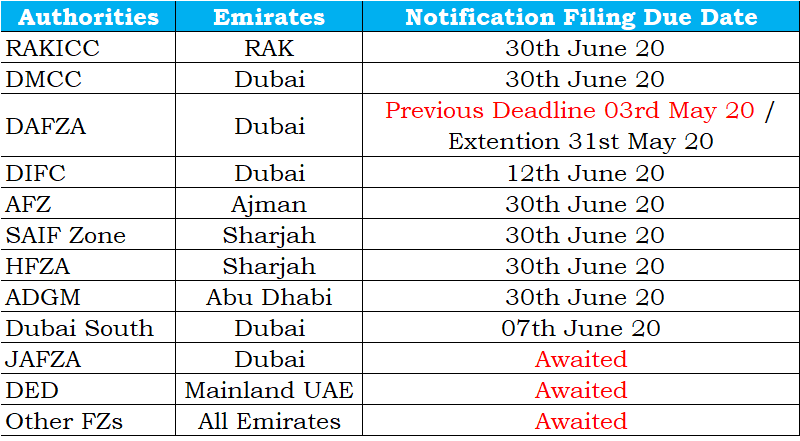

In addition to the annual notification requirement, Licensees that undertake and earn income from a Relevant Activity are also required to file an Economic Substance Return within 12 months from the end of their relevant financial period. Penalty for Non Compliance:

In case you fail to comply with the ESR guidelines, the there are PENALTY provisions which are as as provided in Article 11 of the Cabinet Resolution No. 31 of 2019 Economic Substance Regulation. The penalty ranges from AED 10,000 to AED 50,000 in the first year of its Non-Compliance and for Subsequent non-compliance, it ranges from AED 50,000 to AED 300,000. Way Forward:

To better prove you are not a robot, please:

You will observe and agree:

✅ "I am not a robot - reCAPTCHA Verification ID: 986020"