Long Awaited Clarification Issued by Federal Tax Authority (VAT P-017)

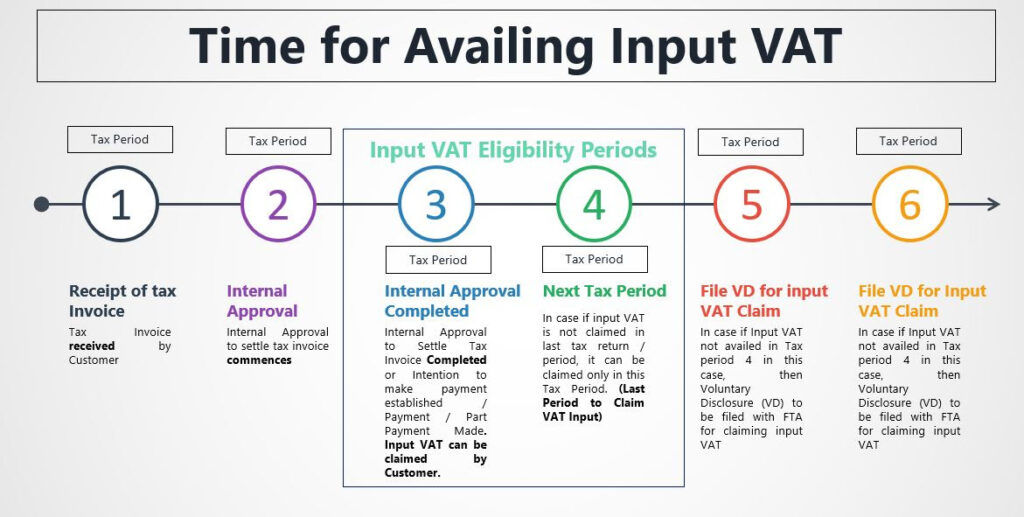

Input tax must be recovered in the first tax period in which two conditions are satisfied: a. the tax invoice is received; and b. an intention to make the payment of consideration of the supply before the expiration of six months after the agreed date of payment is formed. A taxable person may receive a tax invoice but may not have an intention to make the payment until the internal approval process for the invoice is completed. In such cases, the conditions of Article 55(1) of the VAT Law are not satisfied as the intention to make the payment before the expiration of six months after the agreed date of payment is not formed. For the avoidance of doubt, please note that where a tax invoice is received in one tax period and the intention to make the payment is formed in a later tax period, the input tax can only be recovered in such later tax period.

Where a taxable person fails to make the payment of consideration before the expiration of six months after the agreed date of payment, the taxable person should reduce the input tax in the VAT Return of the tax period following the expiry of the six-month period. However, once the payment is made, the taxable person will again be entitled to recover the input tax. Please write back to us or contact our tax experts in order to get more information on the new clarification issued by Federal Tax Authority.

Disclaimer – All the articles in the updates section are brief general description for the tax clarification / guides / decision, etc issued by Tax Authority. Before acting on such information, please consult our tax advisers in order to get detailed idea about its applicability on various business models and scenarios.